Cryptocurrency Prices Today : The cryptocurrency market remains a hot topic as investors across the U.S. closely watch price fluctuations, particularly following recent macroeconomic shifts and global tech developments. On April 7, 2025, top digital assets are showing notable movements, offering new insights for traders, investors, and crypto enthusiasts.

Let’s break down the top 5 cryptocurrencies by market cap based on their latest price data, market trends, and performance analysis.

Cryptocurrency Prices Today

1. Bitcoin (BTC) Price Today

- Price: $77,290.88

- 24h Change: -6.91%

- Market Cap: $1.51 Trillion

- 24h High/Low: $83,501 / $77,127

Bitcoin continues to dominate the digital asset space, but today marks a significant dip below the $80,000 mark. Analysts point to increasing regulatory scrutiny and global economic uncertainty as contributing factors. Despite this dip, long-term investor sentiment remains cautiously optimistic, particularly with institutional interest still strong in Q2 2025.

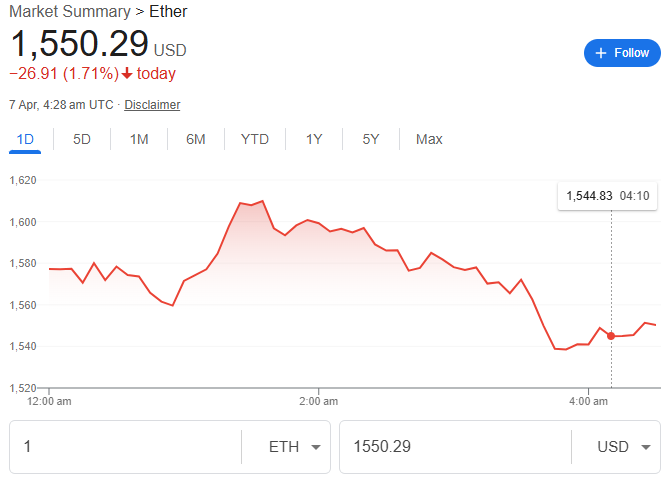

2. Ethereum (ETH) Price Today

- Price: $1,550.29

- 24h Change: -14.66%

- Market Cap: $185 Billion

- 24h High/Low: $1,811.77 / $1,535.33

Ethereum has seen sharper declines than Bitcoin, attributed to market volatility and a cooldown following a bullish March. With ETH 2.0 upgrades continuing to evolve, developers remain bullish. Gas fees are also relatively low compared to 2024 levels, which may aid future scalability and adoption.

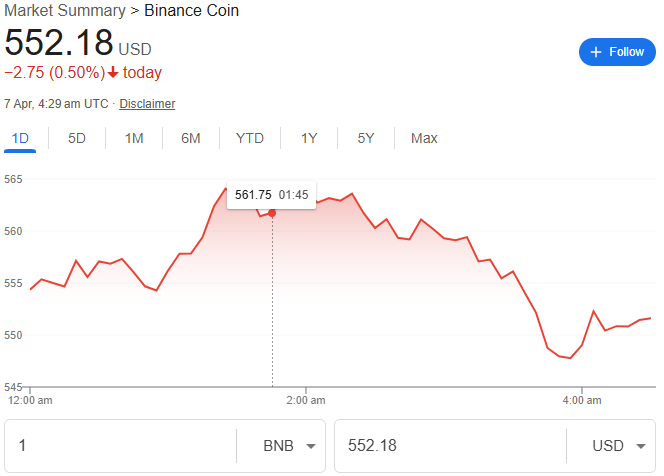

3. Binance Coin (BNB) Price Today

- Price: $552.18

- 24h Change: -7.18%

- Market Cap: $87 Billion

- 24h High/Low: $592.96 / $544.80

BNB has dropped alongside the broader market, though Binance’s continued growth in DeFi and NFT infrastructure offers some support. However, recent reports about regulatory probes into centralized exchanges have caused temporary sell pressure on exchange-backed tokens like BNB.

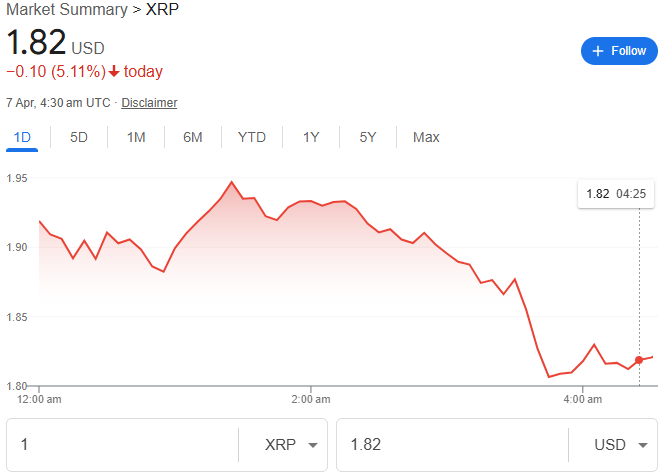

4. Ripple (XRP) Price Today

- Price: $1.81

- 24h Change: -15.02%

- Market Cap: $98 Billion

- 24h High/Low: $2.13 / $1.81

XRP saw a major price correction today, sliding over 15%. While Ripple Labs continues to gain traction in international payment corridors, legal clarity in the U.S. remains a critical milestone. Traders are watching closely for updates on the SEC case and institutional adoption in Latin America and Southeast Asia.

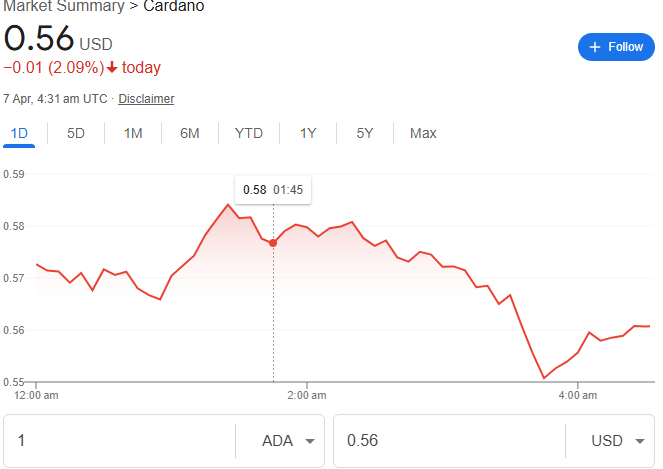

5. Cardano (ADA) Price Today

- Price: $0.5546

- 24h Change: -14.19%

- Market Cap: $19 Billion

- 24h High/Low: $0.6477 / $0.5516

ADA is trending lower following a relatively strong start to Q1. Despite several ecosystem developments including smart contract deployments and partnerships with African governments, Cardano hasn’t escaped the market-wide correction. However, its long-term fundamentals still appeal to retail investors and developers alike.

Read More – AI in Stock Market Trading: Revolutionizing Investment Strategies

The total crypto market cap fell below $2.2 trillion, signaling a correction phase. Most altcoins mirrored Bitcoin’s bearish sentiment. Several analysts believe this dip could be an opportunity for long-term entry, especially as institutional investors continue to show interest in ETFs and digital asset-backed products.

Market Overview (April 7, 2025)

Key factors impacting prices today:

- U.S. Federal Reserve policy updates

- Global inflation trends

- Ongoing crypto regulations

- NFT and DeFi project developments

- Crypto ETF approvals in the U.S.

Crypto Market Sentiment

Despite today’s red charts, long-term sentiment remains moderately bullish. Many investors are “buying the dip,” especially in altcoins like Solana, Chainlink, and Avalanche. If Bitcoin can hold above the $75,000 support level this week, we could see a bounce-back across major tokens.

Expert Insight

Financial analysts from major U.S. trading platforms like Coinbase and Kraken are advising cautious optimism. The market correction, while significant, is seen as a healthy reset after March’s explosive growth. With institutional interest rising and adoption increasing globally, April could still end on a bullish note.

Crypto Investment Tips for April 2025

- Diversify: Don’t rely solely on BTC and ETH. Look into utility-based tokens.

- Stay Updated: Follow U.S. regulatory news for potential price impacts.

- Use Trusted Exchanges: Security and compliance are critical in 2025.

- Set Stop-Losses: Market volatility demands risk management.

- Think Long-Term: Focus on adoption and real-world utility.

Final Thoughts

Today’s crypto market dip doesn’t signal the end—it’s a recalibration. Smart investors are keeping a close eye on support levels and taking advantage of the lower entry points. Whether you’re a seasoned trader or just entering the world of digital assets, the current environment presents both risks and opportunities.

Keep following real-time market trackers and updates from reliable sources to stay ahead.