AI in Stock Market Trading : The integration of Artificial Intelligence (AI) in stock market trading is one of the most transformative developments in recent years. As technology continues to evolve, AI is playing an increasingly critical role in how investors, traders, and financial institutions approach the market. AI tools are capable of analyzing vast amounts of data, identifying patterns, and making predictions that would be difficult or impossible for humans to replicate. In this section, we’ll explore the impact of AI on stock market trading, its advantages, and how investors can leverage it to make smarter investment decisions.

1. The Rise of AI in Stock Market Trading

AI-powered trading systems, also known as algorithmic trading or quantitative trading, are reshaping the way stock market participants make decisions. These systems use machine learning, neural networks, and other AI techniques to analyze market data in real time, identify trends, and make buy or sell decisions based on pre-programmed criteria. These trading bots are capable of making split-second decisions that can take advantage of even the smallest market fluctuations.

One of the key reasons AI has become so prevalent in stock market trading is its ability to process vast amounts of data at high speeds. Whether it’s analyzing news reports, earnings reports, economic indicators, or historical price data, AI can synthesize information quickly and more accurately than human traders.

Read more – Latest Crypto Trends in the U.S. and India (2025) – Market Analysis & Predictions

2. Key Advantages of AI in Trading

a. Speed and Efficiency

AI can process and analyze market data at incredible speeds, allowing traders to execute trades in milliseconds. This speed is essential in high-frequency trading (HFT), where profits can be made from minute price changes. AI systems can automatically execute complex trades without human intervention, providing traders with a competitive edge in volatile markets.

b. Enhanced Data Analysis

AI systems are designed to analyze vast amounts of data beyond just historical stock prices. They can analyze news, social media sentiment, geopolitical events, and macroeconomic data to gain a deeper understanding of market movements. This ability to process unstructured data gives AI a unique advantage over traditional trading methods.

c. Reduced Human Error

Human traders are prone to emotional decision-making, which can lead to costly mistakes. AI systems, on the other hand, operate without emotions, making them less likely to panic during market downturns or become overly optimistic during bull markets. By sticking to algorithms and data-driven strategies, AI helps mitigate the impact of human error.

d. Predictive Analytics

One of the most significant benefits of AI in stock market trading is its predictive capabilities. Machine learning algorithms can identify patterns and trends in historical market data, providing insights into potential future market movements. This allows investors to make more informed decisions based on data-driven predictions, rather than relying solely on intuition or gut feelings.

e. Customizable Trading Strategies

AI-based systems can be tailored to suit an individual investor’s risk tolerance, time horizon, and investment goals. Traders can customize the algorithms to follow specific strategies, such as trend-following, mean reversion, or arbitrage. This flexibility makes AI an appealing tool for both institutional investors and individual traders.

Read More – Reciprocal Tariffs and Their Impact on Global Trade: A Deep Dive into U.S. Trade Policy in 2025

3. How AI is Shaping Stock Market Investment Strategies

a. Algorithmic Trading

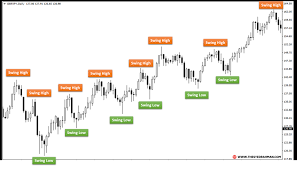

Algorithmic trading is one of the most common applications of AI in the stock market. In this approach, algorithms are programmed to follow a set of predefined instructions, such as when to enter or exit a trade, based on specific conditions like price movements, volume changes, or technical indicators. These systems can execute hundreds or even thousands of trades in a fraction of a second, making them ideal for fast-paced markets.

b. Sentiment Analysis

AI-driven sentiment analysis tools use natural language processing (NLP) to analyze news articles, social media posts, and earnings calls to gauge market sentiment. For instance, if a positive earnings report causes a spike in public sentiment for a particular company, AI algorithms can identify this trend and adjust trading strategies accordingly.

c. Robo-Advisors

Robo-advisors are AI-powered platforms that provide automated investment advice to individual investors. These platforms assess an investor’s financial situation, goals, and risk tolerance, then use AI algorithms to recommend a diversified portfolio of stocks, bonds, and other assets. Robo-advisors have democratized investing by making it accessible to the average person without requiring a large amount of capital or expertise.

d. High-Frequency Trading (HFT)

High-frequency trading relies heavily on AI and machine learning to make rapid, small profits from market inefficiencies. Using sophisticated algorithms, HFT firms can execute thousands of trades per second. While high-frequency trading is typically used by large institutional investors, its growth has influenced how other traders approach the market, focusing on speed and precision.

Read More – Bitcoin Price Target and Latest News With Key Factor

4. Challenges of AI in Stock Market Trading

While AI offers significant advantages, its implementation in stock market trading is not without challenges:

a. Market Overreliance on Algorithms

One concern with the rise of AI in trading is the potential for market instability if too many participants rely on similar algorithms. If multiple AI systems are all responding to the same market signals in the same way, it could lead to sudden price movements or “flash crashes.”

b. Data Quality and Accuracy

AI systems are only as good as the data they are trained on. Poor-quality or inaccurate data can lead to flawed predictions and trading decisions. Ensuring that AI systems have access to reliable and accurate data is essential for their success in stock market trading.

c. Regulatory Concerns

The use of AI in stock market trading has raised questions about market fairness and regulation. Regulators are concerned about the potential for market manipulation, insider trading, and other unethical practices facilitated by AI technology. Striking a balance between innovation and regulation will be critical as AI continues to evolve in the financial markets.

Read More – Donald Trump’s Return to Office and Its Impact on Cryptocurrency in 2025

5. The Future of AI in Stock Market Trading

The future of AI in stock market trading looks promising. As machine learning algorithms become more sophisticated, they will likely continue to improve in accuracy and efficiency. We may see AI systems that not only predict market movements but also adapt in real-time to changes in the market environment, offering even more powerful tools for traders and investors.

AI’s role in enhancing trading strategies, reducing human error, and improving predictive analytics means it will continue to be an integral part of stock market operations. However, the challenge will be to use these tools responsibly and ethically, ensuring that they benefit all market participants.

Conclusion

AI has undoubtedly revolutionized stock market trading, enabling investors to make faster, more data-driven decisions. From algorithmic trading and sentiment analysis to robo-advisors and high-frequency trading, AI has provided tools that were once unimaginable. As AI continues to evolve, its impact on the stock market will only grow stronger, offering investors new opportunities and challenges.

For both seasoned traders and newcomers to the market, understanding and leveraging AI in trading strategies can provide a significant edge. By staying informed about the latest advancements in AI and integrating these tools into investment strategies, investors can position themselves for success in the increasingly digital future of stock market trading.

Disclaimer

This article is for informational purposes only and should not be construed as financial advice. Stock market investments carry risks, and it is recommended that you consult with a licensed financial advisor or professional before making any investment decisions. Past performance is not indicative of future results. The use of AI in stock market trading involves complex algorithms, and the outcomes may vary based on various factors, including market conditions and data accuracy. Always perform thorough research and due diligence before engaging in any trading strategies.