Bitcoin Price and Market Performance : As of early April 2025, Bitcoin is trading at approximately $81,687, reflecting a 5.53% decline from its recent high of $88,500. This follows a volatile March, during which Bitcoin briefly dipped to $78,000 due to macroeconomic uncertainties, inflation concerns, and rising gold prices. However, many analysts remain bullish, predicting a possible rise to $100,000 or even $159,000 in the coming months, provided market conditions remain favorable.

Key Factors Driving Bitcoin Price in April 2025

1. Institutional Adoption and Government Recognition

Bitcoin is gaining wider recognition as a strategic asset. The Oklahoma House recently passed the Strategic Bitcoin Reserve Bill, following in the footsteps of Texas, Arizona, and Utah. These developments reinforce Bitcoin’s legitimacy as a state-level treasury asset, potentially boosting institutional adoption and price appreciation.

Additionally, Bitcoin ETFs (Exchange-Traded Funds) continue to attract institutional investors, further integrating Bitcoin into the mainstream financial ecosystem. This growing acceptance could provide a strong foundation for Bitcoin’s price to sustain higher levels .

2. Historical April Trends Suggest Bullish Momentum

Historically, Bitcoin has performed well in April. In previous years, Bitcoin saw a 20% gain in April 2021 and a 15% rise in April 2022. Analysts predict that April 2025 could follow a similar pattern, with increased investor interest and bullish sentiment contributing to potential price increases.

3. Increased Trading Volume and Positive Market Sentiment

Bitcoin’s trading volume has surged to $50 billion, marking a 30% increase compared to the previous week. This spike suggests that investors are positioning themselves for an April price rally. Furthermore, the Bitcoin Fear & Greed Index has risen from a neutral 50 to a bullish 65, indicating a shift in market sentiment toward optimism.

4. Macroeconomic Events and U.S. Trade Policies

A major event impacting Bitcoin’s trajectory is President Trump’s new global tariffs, set to take effect in April 2025. Historically, increased tariffs have negatively impacted risk assets like Bitcoin. However, if these tariffs are less aggressive than expected, investors may react positively, leading to increased capital inflows into Bitcoin .

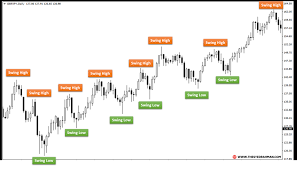

5. Technical Indicators Support a Bullish Outlook

Several technical indicators suggest that Bitcoin may be poised for further growth:

- Golden Cross Formation: Bitcoin’s 50-day moving average has crossed above the 200-day moving average, a classic bullish signal.

- Relative Strength Index (RSI) at 60: This indicates that Bitcoin is not yet overbought, leaving room for further upward movement.

- Bollinger Bands Widening: The current range suggests increased price volatility, with potential for a breakout .

Read More – Donald Trump’s Return to Office and Its Impact on Cryptocurrency in 2025

Will Bitcoin Hit $100,000 Soon?

While predictions vary, many analysts believe Bitcoin could break the $100,000 mark in 2025. Some optimistic forecasts even suggest a potential rise to $169,046 by the end of the year. However, this bullish outlook is contingent on:

- Continued institutional adoption.

- Favorable macroeconomic conditions.

- Sustained investor sentiment and trading volume.

Despite potential short-term volatility, Bitcoin’s long-term trajectory remains positive, with increasing adoption and mainstream integration reinforcing its position as a leading digital asset .

Final Thoughts

April 2025 could be a crucial month for Bitcoin, with factors like institutional adoption, market sentiment, technical indicators, and U.S. trade policies playing key roles in shaping its price action. While short-term fluctuations are expected, the broader trend suggests that Bitcoin remains on a strong upward trajectory, potentially reaching new highs in the coming months.